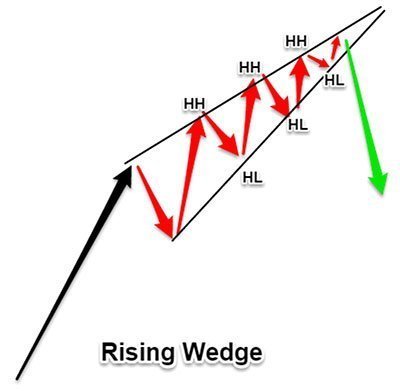

On the contrary, if the rising wedge is formed during the upward trend, the price will likely continue its downward movement. If the rising wedge is formed on the downtrend, the price is likely to continue its fall. When such a formation takes place, it is important to determine the corresponding market conditions. This pattern is both a reversal pattern and a trend continuation pattern.

Having additional information about the price behavior, you can enter a short position with a tight Stop Loss earlier (e.g., at the end of the formation of the second top), before breaking through the neckline. Use additional tools and indicators to confirm the formation of the figure. This technique is preferable in terms of risk management. When opening a trade at breakout it is important to set a tight Stop Loss, just above the support line. The M-shape pattern is easy to analyze and is often seen on the popular cryptocurrencies’ charts.Ī breakout below the neckline is a signal to open a trade, but if you prefer a more steady and low-risk approach, it is suggested to wait for the retest of the support level. The Double Top pattern is an uptrend reversal figure hence its formation indicates the beginning of a bear trend. Also take into consideration the specifics of the market and the asset you trade while determining when to close your position. Keep in mind that in this case, the chance of Stop Loss execution caused by sudden increase in volatility is higher. Tighter Stop Loss is advised and may be set above the support level to trade in a safer fashion and reduce risks. These volume swings are caused by the market participants’ psychology and show the fall of buying volumes, followed by the growth of selling volumes as a result of the upward impulse exhaustion. The volumes may start dropping as the price moves from the left shoulder towards the head, and as the figure forms towards the right shoulder they may start growing. When analyzing the figure’s formation, it is important to consider other signals, such as volume. A tight Stop Loss above the neckline would be optimal. Stop Loss should be set at the right shoulder levels. This could lead to the failure of the pattern’s formation and continuation of an uptrend. The risks lie in a chance of a false breakout and the formation of a bear trap. Entering a short position after the support line is broken: In this case you do not wait for the neckline retest to confirm the breakout. There are several entry points when working with head and shoulders pattern the choice is solely yours and depends on your trading strategy.ġ. The break through the neckline is a signal for the formation of the pattern. Also the more horizontal the neckline is, the higher the chances of the reversal are. It is vital to pay attention to the distance between the tops when analyzing the pattern: equidistant distance between the head and shoulders indicates the higher probability of the figure’s formation. The head and shoulders pattern depends on the timeframe and the strength of the upward movement.

0 kommentar(er)

0 kommentar(er)